We're exhibiting at E-World | Register & Secure your Meeting

Germany, Essen | 11-13 February

Germany, Essen | 11-13 February

3 December 2024

Juan Ortiz

Article 6.2 allows countries to trade emissions reductions bilaterally and count them towards their National Determined Contributions (NDCs), promoting cross-border collaboration. It enables buyer countries—typically developed nations—to invest in carbon reduction projects within “host countries”, often developing nations, to support their mitigation efforts.

The host country must adjust its carbon inventory, transferring the corresponding mitigation outcomes (ITMOs) to the buyer country. This approach directs financial resources to areas where they can be most impactful.

.png)

Article 6.4 establishes the Paris Agreement Crediting Mechanism (PACM), a global framework under the UNFCCC’s Article 6.4 Supervisory Body that enables the issuance and trading of certified carbon credits (A6.4 ERs). Using a centralised registry and standardised methodologies, the mechanism ensures transparency, environmental integrity, and alignment with host countries' climate goals.

(For more detailed information on Articles 6.2 and 6.4, read our dedicated feature, here)

For corporates looking to use the Voluntary Carbon Market (VCM) as a tool to mitigate their environmental exposure, the PACM is designed to provide a foundation of confidence and credibility. The rigorous oversight by the Supervisory Body ensures the credibility of carbon credits through a UN backed, internationally recognised set of standards. This reduces reputational risks and enables businesses to confidently compensate for their hard-to-abate emissions. VCM credits will increasingly seek alignment with these standards, reinforcing their integrity and role in achieving measurable climate benefits.

The approval of Article 6 resolved key issues, including revocation clauses, credit transfers from the Clean Development Mechanism (CDM), and the establishment of eligibility standards. This blog explores these developments as well as the impact on the VCM, pricing expectations, participating countries, CORSIA interactions, and next steps.

.jpg)

Leading up to COP29, a key concern for negotiators and stakeholders was the lack of clarity surrounding the revocation of credits. This is the process of cancellation or withdrawal of authorisation for mitigation outcomes by a host country. This issue was finally resolved at COP29 with the introduction of a clause that addresses revocation in the finalised Article 6.2 text. Once ITMOs have been "first transferred", they cannot be affected by revocations unless otherwise specified by Parties.

The term “first transfer” refers to when the Corresponding Adjustment is made, either at authorisation, issuance or at retirement. This offers greater clarity on associated risks, thereby enhancing the financial viability of projects. Developers can plan confidently, and investors are better positioned to assess and finance ITMO projects, encouraging greater funding.

Another issue that was addressed was clarity over the requirements for the transition of CDM credits to PACM under Article 6.4.

Only credits from projects meeting the high methodological standards outlined by the Supervisory Body are eligible for transfer.

During the negotiations, credits from afforestation and reforestation projects were approved to transition to PACM provided they meet these specific standards.

In line with this, Article 6.4’s Supervisory Body is now in the process of reviewing CDM projects to determine which can be used to issue Article 6 compliant carbon credits. Moving forward, Article 6 projects will be aligned with the Integrity Council for the Voluntary Carbon Market’s (ICVCM) Core Ccarbon Principles (CCPs) directly.

During COP the ICVCM approved three forest conservation methodologies under its Core Carbon Principles (CCPs), including Verra’s recent “Reducing Emissions from Deforestation and Forest Degradation” (REDD - VM0048) methodology, as well as their Jurisdictional and Nested REDD+ framework (JNR) and Architecture for REDD+ Transactions (ART).

The list of the other approved methodologies is available here.

These approvals will increase the availability of forest carbon credits eligible under Article 6.

There is uncertainty around exactly how the Voluntary Carbon Market (VCM) and the Paris Agreement Crediting Mechanism (PACM) will interact. Some proponents predict a harmonised side-by-side coexistence of both markets, with the VCM gradually aligning itself with PACM standards, thus driving higher quality standards across the voluntary market.

Others predict that the establishment of Article 6 mechanisms could lead to the cannibalisation of the VCM, as high-quality VCM projects that meet Article 6 standards transfer to Article 6 eligible mitigation outcomes.

Analysts predict that the establishment of a UN-backed standard will likely lead to a price premium, driven by compliance costs as well as perceived quality standards. If this is the case, Article 6 will serve as an anchor aligning the VCM to higher integrity and accountability standards.

This will result in a market incentive for projects to align with the robust requirements of Article 6, thus enhancing the overall credibility and value of the VCM. At the corporate level, greater participation in the VCM will be encouraged through clear, globally recognised benchmarks tied to the Paris Agreement.

It is difficult to predict how the interaction between the VCM and the PACM will unfold in practice. However, one thing is clear: Article 6.4 will act as a catalyst for higher integrity and quality standards across global carbon markets.

The approval of Article 6.2 and 6.4 was received with very positive initial momentum, with Norway announcing a large $740 million investment to fund Article 6 activities, Switzerland finalising 14 Article 6.2 bilateral agreements and Japan progressing its Joint Crediting Mechanism (JCM) finalising 29 such agreements.

The UK have stated that for the time being, it will not use Article 6 towards its NDC.

However, they have recently announced large investment packages supporting carbon markets. At COP29, they pledged £239 million to support forest-rich nations, with £188 million for the World Bank’s Scaling Climate Action by Lowering Emissions (SCALE) programme, and £48 million to boost private forestry investment.

This follows the UK’s newly announced the Principles for Voluntary Carbon and Nature Market Integrity, designed to leverage the VCM to cut emissions, attract climate finance, and restore nature.

Member states are expected to update their NDCs in February 2025 in line with the Paris Agreement’s 2030 target of reducing at least 45% of global emissions compared to 2010 levels.

With the 2030 deadline fast approaching and many countries still far from meeting their targets, there is a strong incentive to leverage Article 6 mechanisms to achieve NDC goals.

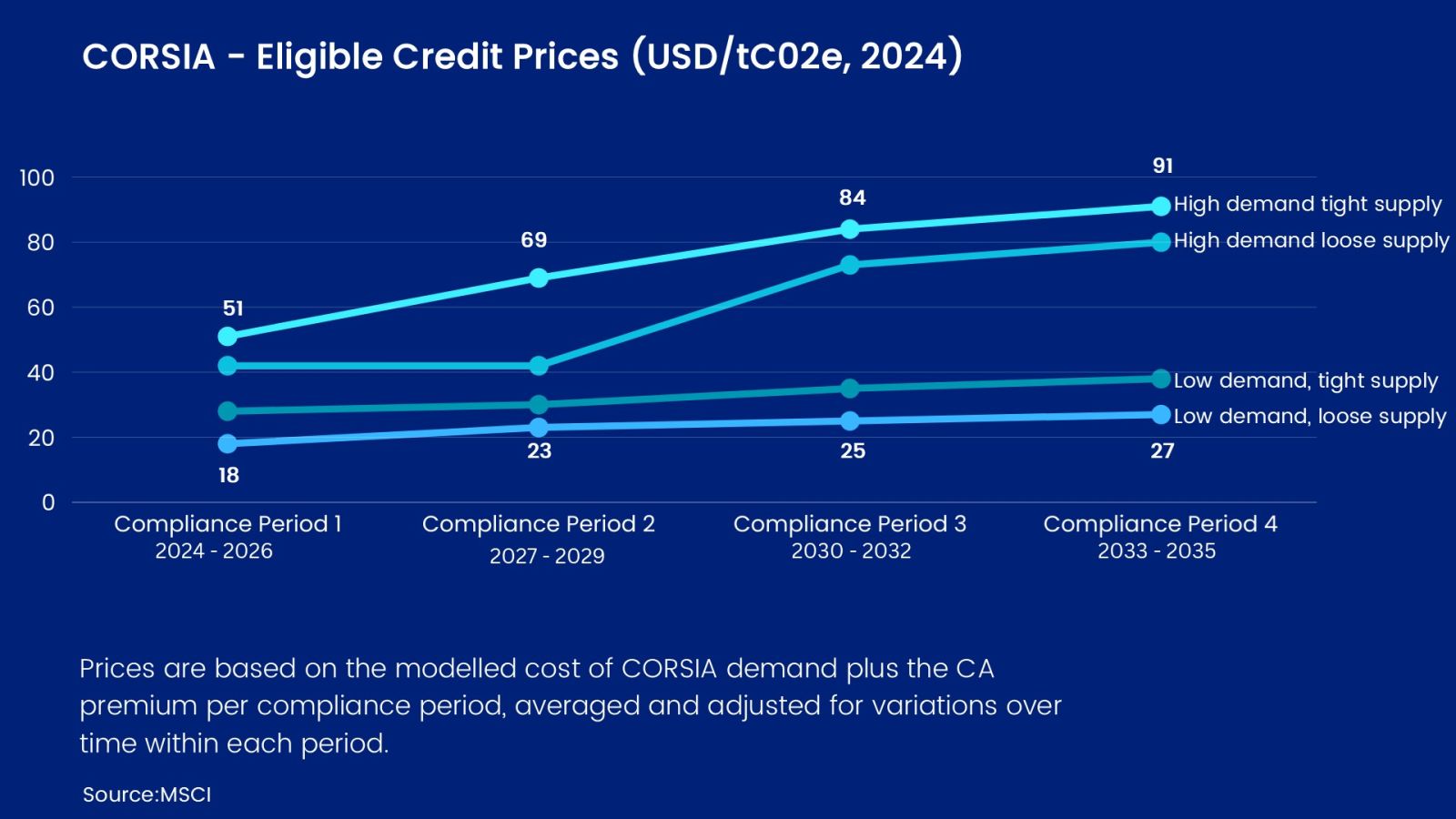

The International Civil Aviation Organisation’s (ICAO) Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) is closely aligned with Article 6 framework. CORSIA utilises Article 6 mechanisms, including the requirement for corresponding adjustments, to avoid double-counting. Under Article 6, credits can be authorised as ITMOs to count towards countries' NDCs, or for “Other Purposes”, including CORSIA.

Specifically, for credits to be eligible under CORSIA, they must be authorised by the host country for Other International Mitigation Purposes (OIMPs). This alignment ensures robust carbon accounting, supporting effective progress towards global climate goals across different sectors.

(For more information on the latest developments of CORSIA, read our dedicated feature, here)

While the rule-making process for Article 6 has concluded, the next phase—the implementation of these frameworks—begins now. Key priorities include establishing national ITMO frameworks, the issuance of A6.4ERs and the full operationalisation of the Paris Agreement Crediting Mechanism, with first expected trades to be seen at the end of 2025.

To ensure a smoother implementation of Article 6 mechanisms, a few key elements still need to be ironed out. These include establishing robust rules for registries, providing clarity over ITMO inconsistencies reporting practices, and refining definitions, particularly around the concept of cooperative approaches.

The implementation of Article 6 mechanisms will foster international cooperation between nations and businesses, channelling investments to regions where they can deliver the greatest impact.

This approach will accelerate countries' efforts to meet their climate targets and drive meaningful progress towards global climate action.

Learn more about CFP Energy and its Voluntary Carbon offering, in this short film.

The UK’s newly released Principles for Voluntary Carbon and Nature Market Integrity represent a significant step forward in leveraging voluntary carbon markets (VCMs) to lower global emissions, attract climate finance, and restore nature. These principles reflect a growing international trend toward creating structured, transparent standards for market participation.

As the aviation industry navigates the first year of the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) Phase 1 (2024–2026), this week’s approvals of additional carbon crediting standards have influenced the market landscape, introducing both opportunities and complexities.

As part of the European-wide effort to achieve net zero, drive the energy transition forward and create a more sustainable world, CFP Energy is working to support organisations based in Germany covered by the national Emissions Trading System (nationales Emissionshandelssystem) (nEHS).